EDITOR’S NOTE: Snow Business interviewed Dr. Stefan Schlag Leon Beraud, founder of Salt Market Information, based in Switzerland. Dr. Schlag Leon Beraud has studied global salt market trends since 2001 and shared his insights on a variety of topics. Unless noted, all data was contributed by Dr. Schlag Leon Beraud and presented in metric tons (mt).

North American capacity & production

2023 capacity in North America was 100 million mt. Actual production was about 60 million mt, with the US accounting for 40 million mt.

.png?width=480&height=310&name=053-01%20(1).png)

According to the USGS Mineral Commodity Summaries 2024 report, US production of salt was an estimated 42 million mt in 2023. The United States is second in world mine production to China (53 mt).

Environmental impact from mining production

Using salt is the best and most economical deicing method; but at what cost to the environment (not related to actual applications)?

- The biggest impact to carbon footprint is attributed to transportation—considering the barges, trains and trucks that move it and the equipment used to unload it.

- Salts have varying carbon footprints. Solar salt, which is created through solar evaporation, has the least (1 kg CO2 per ton), whereas mined rock salt is below 10 kg CO2 per ton. Vacuum salt, processed using vacuum extraction, can be as high as 100 kg CO2 per ton.

Pricing & consumption

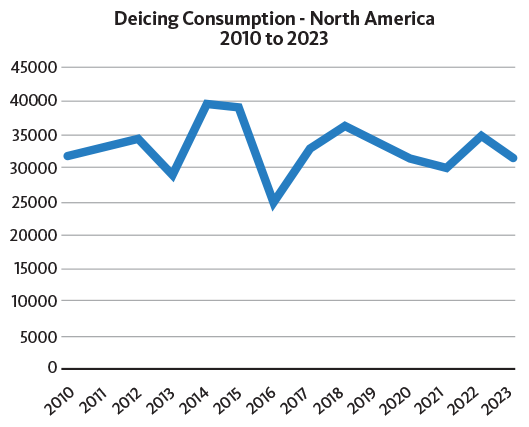

Consumption in 2023 remained lower than 2019 levels after the pandemic affected production and throughout around the world since 2020. Increased energy costs negatively affected salt markets as increased processing and especially transportation costs negatively affected the ability to import and export salt at competitive prices for some international transactions.

44% - North American salt consumption attributed to deicing treatments in 2023 compared to the chemical industry (30%) and others [food, water treatment, medical/pharmaceutical, feed and "other"] (27%).

75% - Percentage of consumption attributed to the United States in 2023 (23,500) vs. Canada (7,780).

Pricing outlook for 2024

Millions of tons of salt are being imported but expect a decrease in prices for 2024. With the global economy slowing, global freight rates went down. Combined with domestic production costs increasing, this could pressure domestic producers to not increase prices significantly.

There has been comparatively little demand in the last few years given the mild winters seen in many areas. Given the El Nino pattern that prevailed in 2023-24, demand is expected to be down, which could impact pricing.

Generally, road salt prices are based on mining costs, transportation and distribution. All prices have increased, but there are enormous differences from state to state and by country. Intermediaries also impact pricing. Only 10%-20% of costs are related to mining the salt. Anticipate $20 USD increase for shipping and handling.

Trends

- 24/7 expectations of black surfaces and increases in traffic density, road networks and parking surfaces is causing higher salt consumption.

- Technology (from traffic guidance systems to better weather services) is playing a role in reducing salt use, along with contractors better understanding the science behind salt use.

- In the next 5-10 years, we’ll see stagnation and decline in salt use due to global warming resulting in less snow and fewer days below freezing.

Primary import locations & prices

Imports from Canada to the United States come from Compass Minerals’ Godrich mine — the largest in the country — via the Great Lakes. There are two main international trade paths:

- Solar salt from Mexico is transported to the West Coast of the US and Canada. Production costs are low due to lower wages and ease of production since energy isn’t required to mine the salt. The mines are close to the sea with access to deep seaports so transportation costs can be minimal.

- Chile (rock salt deposits close to the coast) and Egypt produce millions of tons for shipment to the US East Coast and Canada.