Private equity firms continue to take a strong interest in the snow and ice management industry.

While overall private equity deal volume across all sectors fell in 2023, the business services sector—and facilities services in particular—continued to be a bright spot attracting attention.

Many private equity firms favor investing in what can be described as essential services and either recurring or reoccurring services. This theoretically provides some insulation from downturns during business cycles. Snow and ice management fits that description, although the exposure to large fluctuations in revenue dilutes some of that interest. Snow and ice service companies that have found ways to moderate that risk are likely to be the most attractive investments.

In addition to the industry’s attractiveness, after initial investments are made in an industry, there is a certain amount of "follow the leader" as other private equity investors may seek similar successful investments.

While private equity activity in the snow and ice management industry is still limited, private equity investment in landscape services and related businesses has grown very rapidly. There are now over 70 private equity platforms investing in various segments of the greater landscape services industry.

Investment targets

Private equity firms have a few ways to invest in snow and ice management, and some companies operate in more than one of these segments:

- Invest directly in service providers who mostly self-perform services.

- Invest in facility management companies whose services are mostly provided by third-party contractors.

- Invest in companies that are primarily known as landscape services businesses.

- Invest in franchise operators whose franchisees perform snow removal services.

A variety of private equity investors are in the market:

- Traditional firms raise funds from institutional investors and invest the funds on behalf of their limited partner investors. These funds typically have a fixed term, and the investments are ultimately sold with the proceeds returned to the investors.

- Family offices often act similarly to traditional private equity but use funds from one or more wealthy families to invest in acquisitions. Family offices are not as constrained as traditional private equity firms in how long they may hold an investment; although in practice, those time horizons are often not greatly different.

Impacts on snow and ice

The trend toward private equity investment will change the industry and affect all snow contractors, whether they are candidates for sale to private equity or not. Here are some of the potential impacts:

- For some contractors, private equity firms are potential buyers. This would include larger and more established contractors.

- Some smaller contractors may be attractive add-on opportunities for existing private equity-backed snow contractors.

- Private equity-backed snow platforms will likely result in more consolidation of a portion of the industry, resulting in larger companies and a potential change in competitive dynamics.

- The presence of private equitybacked companies may enhance the trend toward professionalizing the snow and ice industry.

- Private equity-backed companies may invest more heavily in technology and cutting-edge equipment.

- Private equity backed-snow contractors may use more professional and effective selling techniques that may provide an advantage over smaller contractors.

New opportunities

Consolidation also creates opportunities for other companies not involved in private equity. There may be customer acquisition opportunities as changes happen with the large players. The changes associated with consolidation may displace some key employees who can boost other companies’ human resources. Even with these impacts, the industry will remain very fragmented with new contractors emerging all the time.

Private equity platforms in snow and ice

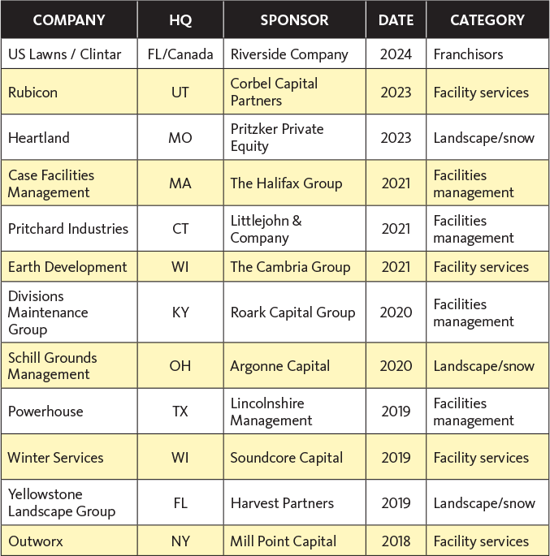

These are among the private equity platforms operating in the landscaping/snow and ice industry since 2018:

Recent notable transactions

Case Facility Management Solutions partnered with The Halifax Group in 2021. In early 2024, Case merged with Landscape Effects Property Management, a prominent provider of landscaping, snow and ice, and other exterior services to commercial customers across Canada.

The Cambria Group invested in Wisconsin-based Earth Development in 2021.

The Riverside Company acquired Clintar, the Canadian snow-removal and landscaping franchise system, ultimately folding it in as a brand under its multibrand franchisor, Eversmith Brands. In early 2024, Riverside acquired US Lawns, the commercial landscaping and snow removal franchise unit of Brightview. Clintar and US Lawns comprise the landscaping and snow removal division within Eversmith Brands, under the leadership of US Lawns’ long-time president Ken Hutcheson. Clintar and US Lawns combined total approximately $300 million in system revenue.

Wisconsin-based Winter Services, LLC, has been backed by private equity firms Soundcore Capital Partners and Two Roads Partners since 2019. Since then, it has completed six add-on acquisitions.

Advanced Service Solutions, a facilities management company with its roots in snow removal, was acquired in 2023 by Powerhouse, a multi-service facilities management company backed by Lincolnshire Management. Advanced Service Solutions was previously a portfolio company of BHMS Investments.

The top private equity-backed landscape contractors, including Brightview, Yellowstone Landscape Group and Heartland, have significant snow services. Brightview has been a major player in snow removal for years. Yellowstone and Heartland have both expanded north in the last few years with many acquisitions, including snow services. In addition, Heartland owns Exterity, a nationwide facilities management company that offers snow removal services.

Ron Edmonds is a partner in Principium | White Oak, which focuses on M&A advisory services for business owners and investors in sectors including snow and ice management. Contact him at 901.351.1510, email ron@principiumgroup.com or visit principiumgroup.com.

-2.jpg?width=775&height=421&name=043-01%20(1)-2.jpg)